This journey has roots in August 2023, a pivotal moment in my pursuit of degrees in Electrical and Electronics Engineering and Physics. While seeking thesis opportunities for my final year, I encountered significant challenges. Most positions required candidates pursuing PhDs or were not open to international applicants. I had progressed in discussions with the Wenshan Wang group at CMU for developing multi-modal models for off-road driving vehicles, but the talks fell through, leaving me disheartened. I stopped applying after a few unsuccessful attempts.

I was desperately looking for some new project to work on. Some new direction to pursue. A chance encounter with a news headline in the campus library led to a short term change in my career strategy. The headline highlighted Citadel's weather analyst team hired from the University of Reading, whose expertise in weather forecasting had translated into billions in profits through oil trading. This convergence of meteorology and finance sparked a new interest, prompting me to explore unconventional applications of my modest expertise in weather modeling. I often wondered that had I not pursued the sciences, economics might have been my alternative path.

I reached out to my friend Shubham Sharma (BITS Pilani Hyderabad, Mechanical Eng + Chemistry (Batch of 2025)) to explore potential collaborations playing upon his financial acumen and my modeling abilities. However, our initial attempts at projects over the next few months faltered due to a lack of genuine passion for the field and the challenges we faced in identifying impactful problems. We suspended our efforts when the semester concluded in December 2023, having made no significant headway.

Fast forward to 12th February 2024, walking back from the gym in the evening, I discussed with Shubham my idea to collaborate on modeling temperature-based derivatives. We had not started yet. For the next week, this would be one of the main points of our discussions everytime we met. And for the most part we would be discussing why such products would not work. In my material review, when I was trying to identify a project worth doing, I come across these weather derivatives that were traded on the Chicago Mercantile Exchange. The CME group had a lot of different kinds of weather based derivatives listed back in the day, but citing a lack of profits as the reason, they had trimmed down to only temperature based derivatives. They still did not have any product listings for India. I really wanted to build them for India.

A week later when I was talking with my friend Hansika Cherukuri (BITS Pilani Hyderabad, Economics (Batch of 2025)) and explaining to her the idea of weather derivatives, I finally decided to quit only ever talking about it and started work by reading all the literature I could find on pricing such derivatives, identifying areas for improvement, and initiating coding efforts. As Shubham was not that proficient in coding, I took on extensive coding responsibilities, running experiments to price and forecast models. Data cleaning and gathering became a major focus, with Shubham initially running most of the market research phase, identifying all the sort of data we would need to analyse the market for such a product in India. At this stage, I must admit that I had little practical understanding of finance. Despite my interest, I had never formally pursued the field. Nevertheless, we persevered, learning so much from each other along the way.

Shubham Sharma working on the Ornstein-Uhlenbeck Process. Yes, our hostel rooms used to be this messy. Sneak peak the gym bag hanging on the door from the night we started.

After a week of intense daily stretches lasting 17 hours, we completed our first joint project: designing and pricing risk averse HDD/CDD contracts tailored for monsoon and winter seasons across 8 Indian cities. Utilising my prior internship experiences, our model achieved exceptional accuracy in forecasting temperature profiles. Shubham's innovative approach to reference temperatures value for our model further enhanced our pricing accuracy compared to existing industry products. Our tail risk tests were also highly promising. Little did we know that every day after this, for the next 2 months, would be more exciting than the last.

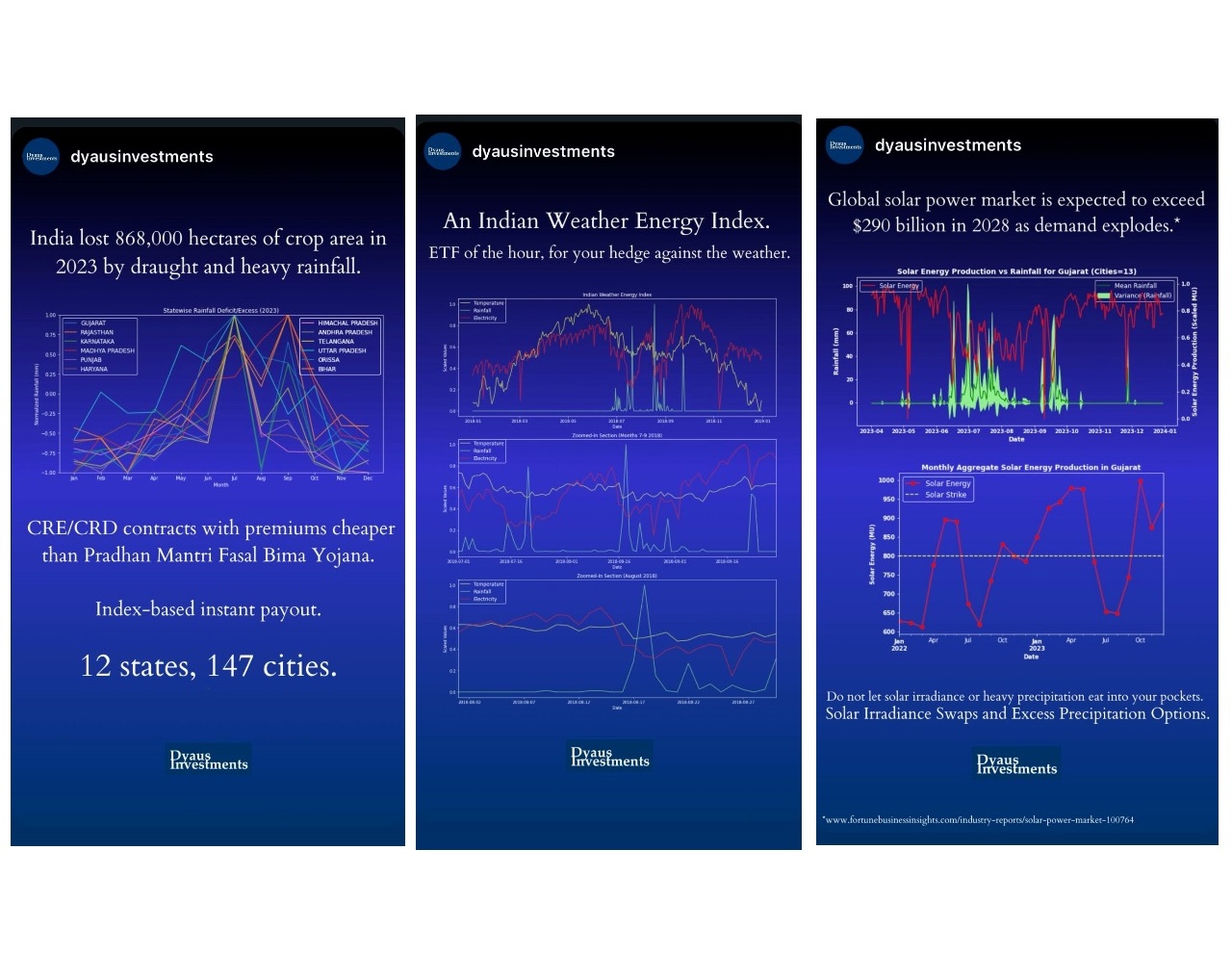

We publicised our results on the temperature derivatives and friends nearby started taking note. They grew interested in our work. This was new to them. Trading the weather was not something they thought was possible. We were very motivated by the response we got from our immediate peers. We decided to scale up and take on more work. There was a significant gap in such products within India—a promising market opportunity, and we having no (absolutely no) idea how this would work, really wanted to make it happen. To our luck, on the 1st of March, 2024, SEBI regulated weather-based financial products legal tender and on the 21st of March, the SEC adopted climate change exposure reports for public companies, legitimising our efforts. We expanded our team to include our friend Kunal Bansal (BITS Pilani Hyderabad, Comp Sci Eng + Chemistry (Batch of 2025)), and embarked on collecting data and preparing mathematical models for more ambitious projects, aiming to create derivatives for wind and rainfall, making swaps on renewable energy, creating a temperature-energy and rainfall-agriculture index and designing N-dimensional quanto as a replacement of the traditional PMFBY and WBCIS schemes.

I was leading product development, data cleaning and coding efforts. This was a very data heavy exercise. Although the models gave the most trouble debugging, and we had to sift through tens of papers to identify the best mathematical techniques, it was the data still, that drained us the most. I would identify all needed data and Shubham and Kunal would start scrapping the entire internet for whatever we could find. For data we could not find at the needed temporal resolution or assured quality control, we would run models to estimate based on other similar parameters for nearby developing countries. I spend days correcting for seeding events in temperature, rainfall and wind data. I spent hours building the best models that used the least parameters to forecast. Financial products on weather needed a tangible data source, almost like an automatic weather station. And it was really hard having to build a model without using satellite or radiosonde data. Because we had to make sure our data was from a tangible, verifiable source. We explored various sectors, including agriculture, energy, and transportation. We processed and built extensive datasets ranging from power trading rates/quantities and soil water requirements to oil and grain commodity spot prices, electricity consumption/production, renewable energy production, coal consumption, ship based cargo transportation and much, much more. We ran unique in-house models to estimate grid dependency on weather and manually calculated how much rainfall each (Lat,Lon) pair would need based on historical crop yield/periods. During Kunal's absence due to personal commitments, Shubham and I pulled multiple alternate day 23-hour shifts to maintain momentum.

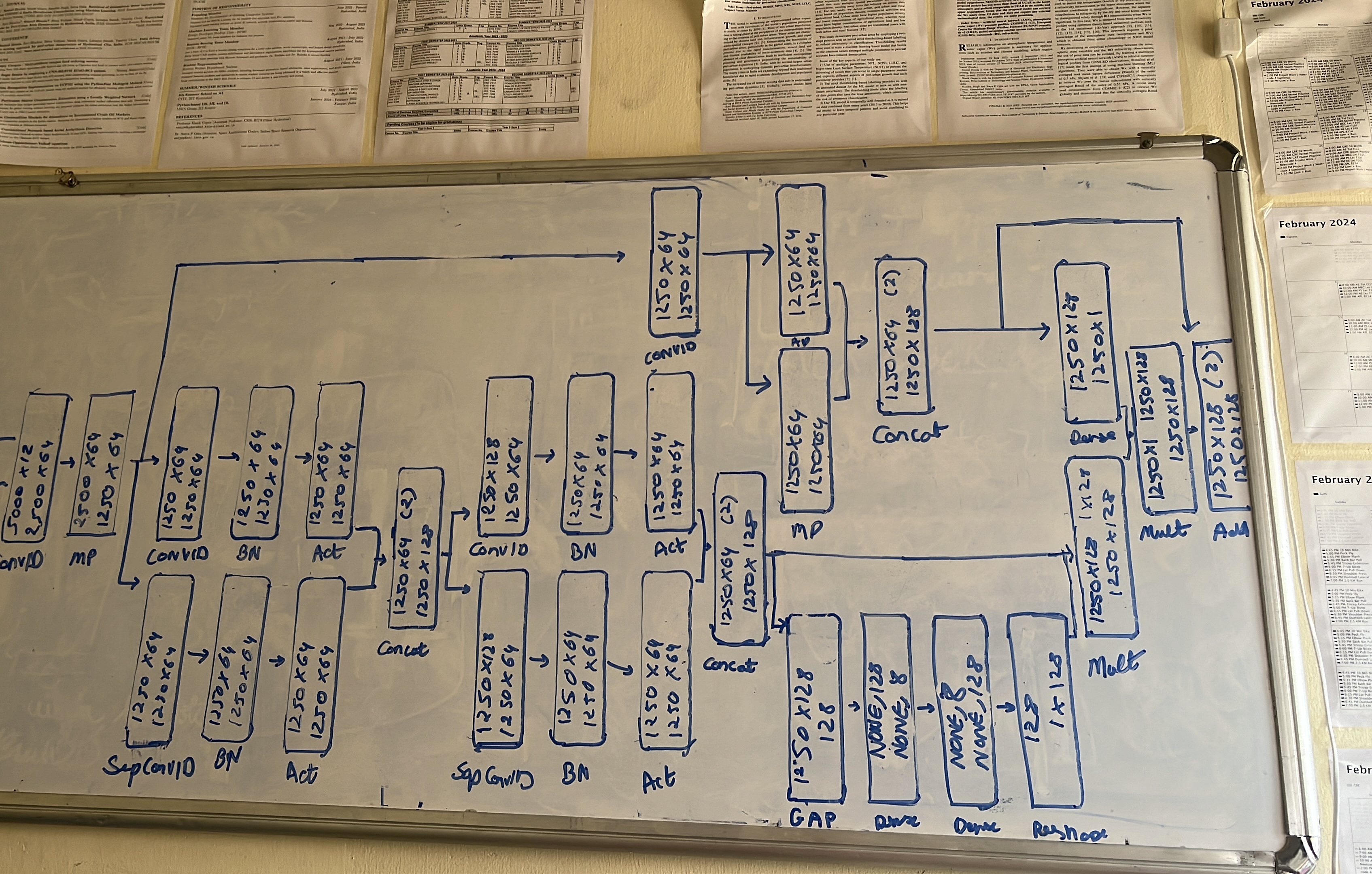

This is what our typical discussion boards would look like. Loads of model architectures and data sheets stuck above.

As we started making progress on our projects we sought the need to understand what we could do with this work we had done and so, we welcomed Utkarsh Agarwal (BITS Pilani Hyderabad, Comp Sci Eng + Physics (Batch of 2025)) and Chaitanya Dandwate (BITS Pilani Hyderabad, Chemical Eng (Batch of 2024)) to our team. Utkarsh brought legal acumen, while Chaitanya provided valuable consultancy based on his internship at Deutsche Bank. Together, we built a lot of products, some survived our stress testing and some did not. I talked to some of my friends studying law at GNLU to understand legalities surrounding derivatives and insurance products. I also started engaging in extensive discussions with small warehouse owners, farmers, and medium-scale renewable energy companies to understand their needs better. We at a point did consider starting our own venture, which we called Dyaus Investments (https://dyausinvestments.com/).

Our almost complete team, missing Chaitanya Dandwate. From L to R, Shubham Sharma, Soumil Hooda, Utkarsh Agarwal, Kunal Bansal, Hrushikesh Reddy.

We compiled comprehensive analysis decks and started pitching our findings to investment banks, insurance companies, and boutique risk management firms. Despite our initial successes, our team faced challenges as individual responsibilities diverged. Engaging with industry professionals—underwriters, chief officers, and product directors—revealed the complexities of scaling our venture without robust legal support and substantial capital investment. We stuck together for some time, finishing up results on our products but soon I found only myself left in the project. I finally hit some progress getting to have extensive talks and meetings, explaining my vision and learning from industry experience, with people such as Marcel Reif and Niraj Shah at Munich Re, and Ralph Renner and Vivek Pawale at Parameter Climate. I would like to thank them.

The semester-long experience was transformative. It encompassed research, market analysis, product development, team-building, pitching, iterative improvements, and more. Many around me inquired about our progress and sought to learn from our journey, marking the beginning of my potential entrepreneurial path. For now I have left behind the days working on weather derivatives, for a career path more assured, but maybe I go back someday. I remain committed to completing manuscripts on our research, intending to make our findings and methodologies open-source, as and when I find time.

This is how we used to imagine running media campaigns for our products. We dreamt of a world where these products were sold in the equity market.